Introduction

Vlogging hasn’t just survived the digital shakeups of the last few years—it’s matured. While flashy trends came and went, the core of vlogging stayed rock solid: story-driven connection. Creators who stuck to their voice, experimented with platforms, and paid attention to shifting viewer habits managed to keep growing—even during algorithm chaos and platform pivots.

But 2024 isn’t about cruising on what worked last year. Major shifts are happening again. Attention spans are getting even shorter. AI is changing how content is made, discovered, and consumed. And platforms like YouTube and TikTok are reworking the rules on visibility and monetization.

Why should creators care? Because the vloggers who notice these shifts early—and build strategies around them—get ahead. This year is less about chasing trends and more about leaning into what makes your content irreplaceable. Consistency, substance, and niche loyalty are becoming the new pillars. Vlogging is adapting. So should you.

Key Voices Across Crypto, Banking, and Tech Share Aligned Optimism

In an industry that often feels fragmented, 2024 is seeing an unusual alignment: key players in fintech, crypto, and traditional banking are sounding a shared note of confidence. The message is clear—digital is no longer optional, it’s foundational.

Kristin Smith, CEO of the Blockchain Association, put it bluntly: “The conversation is no longer about whether crypto belongs in finance. It’s about how fast institutions are willing to adapt.” That urgency is mirrored by executives in more traditional corners. Citi’s Head of Global Digital Strategy, Michael Silva, noted in a recent panel, “Digital rails aren’t an experiment—they’re the infrastructure now. If you’re slow, you’re irrelevant.”

Even major tech voices are doubling down. Stripe co-founder John Collison recently tweeted, “Infrastructure is the moat. Payments, identity, and compliance are merging fast—and builders who ignore that will lose.”

There’s no more waiting for a so-called digital tipping point. We’ve passed it. What’s coming next is integration at scale, across sectors. For vloggers covering finance or tech—this mix of urgency and opportunity is content gold.

The takeaway: whether you’re building, investing, or just trying to keep up, the mindset has flipped. Digital-first is the default. Fall behind, and you won’t just lose momentum—you’ll lose market share.

Decentralization: The appeal is simple—no gatekeepers. Vlogging platforms haven’t fully embraced it yet, but the idea is gaining steam. Decentralized tech can mean faster uploads, borderless access, better privacy, and fewer risks tied to centralized policy changes or outages. For creators, it’s about control—owning your content and distribution without relying on a server farm halfway across the world.

Cost Efficiency: Creators are watching middlemen fade. Transaction fees on donations, tips, and subscriptions are dropping when built on decentralized rails. Whether it’s blockchain-powered payouts or smart wallets baked into platform layers, vloggers are seeing more of what they earn.

Financial Inclusion: The next billion viewers (and potential creators) don’t live where traditional banking is easy. Decentralized systems—think crypto-friendly wallets or platforms not tied to Western banks—give underbanked regions a voice. More people mean more creators, more audiences, more growth.

Programmability: Smart contracts make it possible to automate payments, rights, and licensing. Think: automatic payout splits with collaborators, or setting rules for remix rights baked into the upload. It’s technical, yes—but the payoff is clarity and control, especially for creators who wear too many hats.

The future of vlogging isn’t just more platforms—it’s different ones. Ones shaped by code, not corporations.

The Rise of CBDCs

Central Bank Digital Currencies, or CBDCs, aren’t just buzzwords anymore—they’re becoming serious policy tools. What started as conceptual whitepapers has turned into real-world pilots from places like China, Sweden, and Nigeria. Even the European Central Bank and the U.S. Federal Reserve are inching toward active exploration.

This isn’t about replacing cash overnight. It’s about giving governments a foothold in the digital currency race while retaining monetary control. Unlike crypto, CBDCs are backed by states. That changes the conversation—from wild speculation to managed innovation.

Regulators, once allergic to anything crypto-flavored, are shifting their stance. The skepticism hasn’t disappeared, but it’s now mixed with strategic curiosity. Fears of shadow economies and loss of control are being weighed against the benefits: faster payment rails, financial inclusion, and better oversight.

In the big picture, CBDCs probably won’t wipe out fiat anytime soon. More likely, they’ll sit alongside traditional currencies—offering another option, not a replacement. Think of CBDCs as a new layer in the financial stack, not a reset button.

Fintech Bets Big on Web3 Tools

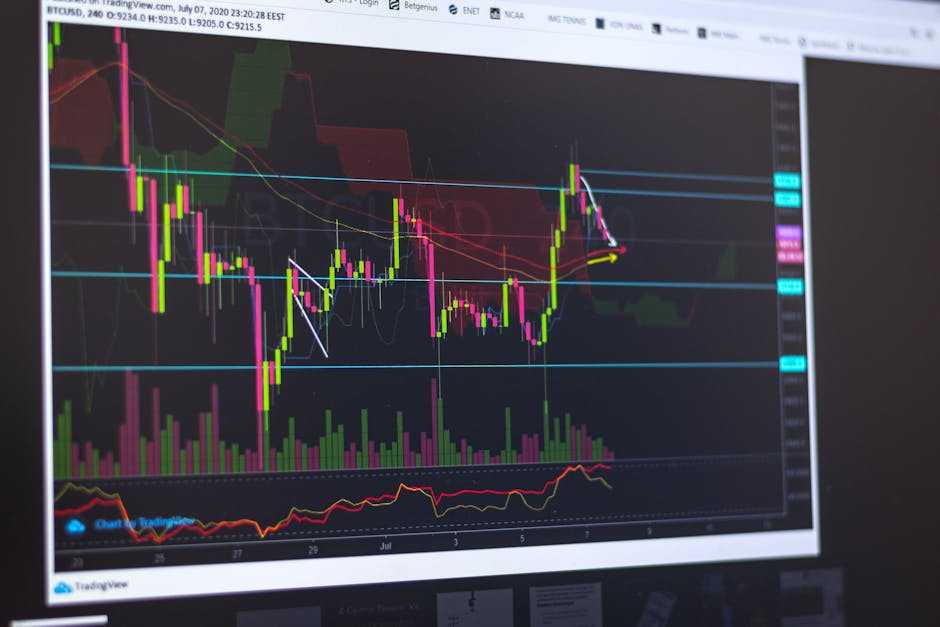

Traditional money is moving into decentralized space, and it’s not just hype anymore. Major financial institutions, fintech giants, and hedge funds are staking claims in areas like stablecoins, crypto wallets, and blockchain infrastructure. It’s less about the headline-grabbing tokens and more about the backbone tech—how value can be stored, moved, and tracked without friction.

Stablecoins are a quiet favorite. They’re fast, relatively stable (for now), and ideal for streamlining cross-border payments. Meanwhile, blockchain infrastructure—think smart contract tools and decentralized identity protocols—is pulling in serious capital. Wallets are also evolving fast, replacing clunky UI with intuitive designs aimed at everyday users.

But it’s not all green lights. Web3 is still swimming in gray areas when it comes to regulation. Volatility makes risk high. Scams haven’t gone anywhere. The investors getting it right take a sober approach—due diligence, strong security protocols, and long-game thinking. They’re not just chasing trends; they’re building guardrails to not get wrecked.

Want a different angle on smart investing? Check out Top Investment Lessons from Billionaire Warren Buffett.

You don’t need to code smart contracts or solve blockchain riddles to start getting involved in digital currencies. The playing field has shifted. Today, regular people—non-techies, side-hustlers, content creators—can dip into crypto with user-friendly platforms, cleaner interfaces, and a ton of auto-generated research tools doing the heavy lifting.

If you’re a creator thinking long term, digital currencies aren’t just a trend—they’re a hedge. They help diversify income streams and open up new monetization angles through decentralized tools. Some vloggers are already earning through crypto tipping, NFT fan rewards, or blockchain-based distribution platforms that pay more fairly than ad-revenue channels. None of this requires you to be a blockchain wizard—it just needs curiosity and a plan.

Start small. Think of it like you’re building a digital emergency fund—or exploring a new angle for audience engagement. Use platforms like Coinbase, MetaMask, or even social-integrated wallets to experiment. Watch how creators are using Web3 tools for loyalty programs, token-gated content, or global payments without platform fees.

You don’t need to go all in. But you should start paying attention. Because digital currencies are weaving into the content economy—and ignoring them means falling behind.

Digital currencies aren’t just part of the future—they’re defining it

What used to be dismissed as nerd money is now reshaping how creators earn, spend, and invest. From brand deals paid in stablecoins to fans tipping through decentralized platforms, digital currencies are no longer a fringe topic—they’re infrastructure. Crypto wallets are becoming as standard as PayPal accounts, and blockchain-backed platforms are openly challenging old guard networks for creator attention.

Fintech’s momentum hasn’t slowed—it’s ramping. New platforms are popping up, offering lower fees, direct creator payouts, and frictionless monetization models. If you’re creating value online and haven’t explored digital currencies, you’re late. And in this space, late can look a lot like invisible.

But don’t dive in blind. The space moves fast, and hype often outpaces reliability. Scams still exist. Promises get inflated. Staying informed matters. So does skepticism. Know where your money goes, who holds your keys, and what’s actually decentralized.

The future is part digital asset, part digital ethic. Get fluent. Stay cautious. Be ready.