Long-Term Mindset: Decades, Not Quarters

Think in Decades, Not Just Quarters

One of the most defining traits of Warren Buffett’s investing strategy is his long-term perspective. While many investors chase quarterly gains or react to daily price movements, Buffett focuses on performance over years—even decades. This long horizon helps him avoid making hasty decisions based on temporary market conditions.

- Avoid short-term hype; focus on long-term performance

- Measure success in years, not trading days or quarterly reports

- Long holding periods allow compounding to work its magic

Buffett’s Take on Market Dips and Crashes

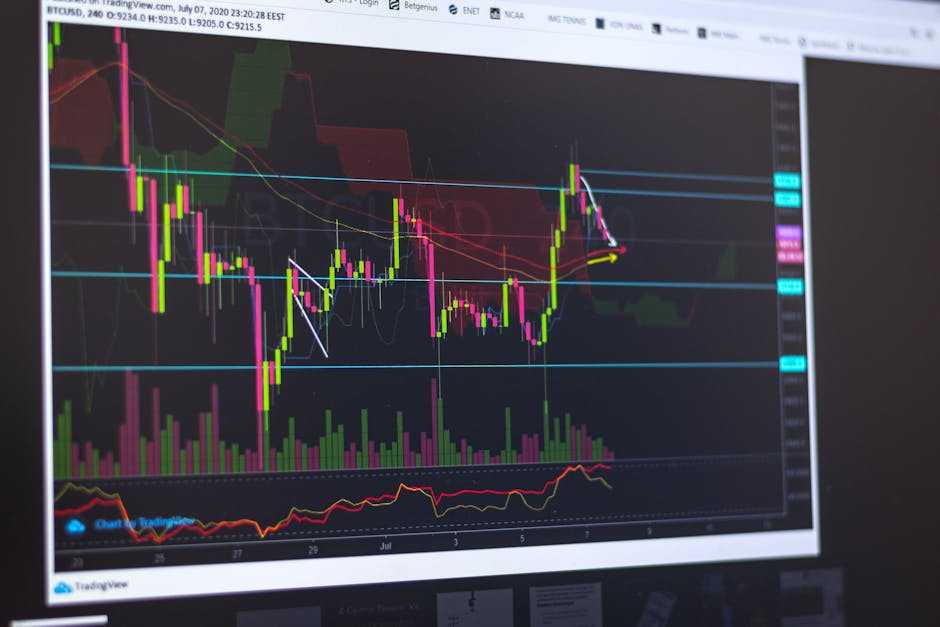

Market downturns aren’t moments to panic—they’re opportunities for strategic investors. Buffett views corrections and crashes as inevitable and often beneficial for long-term portfolio growth. Instead of retreating, he prepares to buy quality assets at discounted prices.

- See volatility as normal, not alarming

- Use downturns to increase positions in high-conviction investments

- Stay calm while others overreact

Tuning Out the Noise

In a world oversaturated with headlines, market speculation, and endless financial opinions, Buffett’s discipline in ignoring daily noise sets him apart. His focus remains on a business’s fundamentals, not media narratives or stock tickers.

- Don’t let daily news dictate your investment decisions

- Rely on research, not hot takes or viral predictions

- Remember: the market is a voting machine in the short term, a weighing machine in the long term

By maintaining a long-term mindset, embracing downturns strategically, and tuning out the noise, investors can follow Buffett’s lead in building lasting wealth.

Warren Buffett’s track record speaks for itself. Through Berkshire Hathaway, he’s turned a struggling textile company into a behemoth touching everything from insurance and railroads to ice cream. His playbook? Long-term value over hype, patience over panic. For decades, he’s zigged while the market zagged—and won.

Even in today’s chaotic, high-frequency trading environment, Buffett’s philosophy stands its ground. While the digital age incentivizes rapid moves and hot takes, his approach reminds investors to focus on what’s real: companies with strong fundamentals and long-term staying power. Especially now, when volatility and noise eclipse clarity, his message matters more than ever.

Buffett’s biggest legacy isn’t just the billions he’s made; it’s his unshakable commitment to simplicity. Buy what you understand. Ignore the frenzy. Play the long game. Amid a sea of flashy portfolios and endless speculation, that kind of clarity cuts through. And that’s something any investor—old guard or next-gen—should pay attention to.

The Circle of Competence Principle

Warren Buffett doesn’t try to be an expert in everything. His success is built on a simple rule: stick to what you know. That’s the core of the circle of competence principle. Instead of chasing hot trends or pretending to understand every corner of the market, Buffett focused on sectors where he had deep understanding—insurance, consumer products, banking. If it fell outside that circle, he passed.

One of the clearest examples? Tech. For decades, Buffett avoided technology stocks, even as companies like Microsoft and Intel were exploding in value. He admitted it wasn’t his domain. That caution kept him from early gains in the tech boom, but it also protected him from massive blows when the dot-com bubble burst in the early 2000s. When he finally invested in Apple, it was after the company had matured into a stable, cash-generating giant—well within the bounds of what Buffett could analyze.

For modern investors, the takeaway is blunt: don’t try to play every game. Learn where you’ve got insight or experience—maybe it’s real estate, energy, or retail—and go deep there. Chasing trends without understanding is how people lose money in bull markets. It’s not about how wide your circle is; it’s about knowing where the edges are.

How Buffett Hedges Against Inflation

When inflation rises, preserving purchasing power becomes top priority. Warren Buffett, known for his disciplined investing approach, has consistently emphasized specific tactics to hedge against inflation’s corrosive effects on capital. His strategy isn’t just about riding out volatile markets—it’s about owning assets that thrive in inflationary periods.

Buffett’s Approach to Inflation Hedging

Rather than shifting to trendy commodities or speculative plays, Buffett relies on a proven framework:

- Invest in productive assets: Businesses that generate reliable cash flow and reinvest efficiently.

- Avoid long-duration fixed-income: Bonds with low yields lose real value quickly during inflation spikes.

- Own high-quality equities: Stocks of companies that can adapt and grow often fare better than cash or bonds.

Pricing Power: Buffett’s Ultimate Inflation Shield

A central theme in Buffett’s inflation strategy is identifying companies with pricing power—the ability to raise prices without losing customers. This advantage allows businesses to maintain or even expand margins, protecting shareholder value.

Key characteristics of companies with strong pricing power:

- Strong brand loyalty (e.g., consumer staples or luxury goods)

- Essential services with inelastic demand

- Market dominance or limited competition

“The single most important decision in evaluating a business is pricing power.”

— Warren Buffett

Why It Matters Now

With inflation uncertainty extending into 2025, understanding hedge strategies becomes more relevant than ever.

For a broader economic perspective, check out this deeper analysis:

How Economists View Inflation Trends Heading Into 2025

Intrinsic Value vs. Market Price

Warren Buffett has said it plainly for decades: price is what you pay, value is what you get. Unlike trend-chasers who move with waves of hype, Buffett digs into the fundamentals—the business model, earnings power, competitive edge. If those pillars are solid but the market hasn’t caught on yet, he sees a deal. It’s not flashy, but it works. He’s not out to time mood swings—he’s hunting value that lasts beyond headlines.

This is how he landed massive long-term wins. Coca-Cola wasn’t cool when he bought in—it was stable, global, profitable. Same with American Express after the salad oil scandal. The market panicked; Buffett didn’t. He bought when the price dropped far below what he judged the business was really worth. Then he waited, and let time do the heavy lifting.

That’s the Buffett method in a nutshell: ignore the noise, find quality, pay below its value, and hold. It’s simple, but not easy. And it only works if you care more about the business behind the ticker than the stock chart in front of you.

Warren Buffett doesn’t mince words when it comes to speculation: it’s not investing. To him, investing is about ownership, not betting. You buy businesses you believe in, at prices that make sense, and you hold them—rain or shine. Speculators, on the other hand, are chasing price movements. They’re trying to outguess the crowd, riding waves and dodging dips. That game rarely ends well.

Buffett warns often against the pull of fast money. It’s exciting in the short term, but unsustainable. Markets swing, bubbles burst, and what feels like quick profit one day becomes regret the next. The danger isn’t just losing money—it’s building bad habits that compound over time: impatience, overconfidence, and knee-jerk reactions.

Discipline is the antidote. A sound portfolio isn’t built on hunches—it’s anchored in research, patience, and diversification. Buffett favors steady compounds. Think broad market index funds, solid dividend-paying stocks, or companies with wide moats and strong leadership. He’s played the long game his whole life. The returns speak for themselves.

When Holding Cash Is Strategic

Cash isn’t just dead weight. In stormy markets, it’s optionality. This is a truth seasoned investors know well—and one that Warren Buffett has practiced for decades. Holding cash isn’t about market timing; it’s about not being forced into bad decisions. When the market dips or liquidity dries up, the investors with cash don’t panic—they shop.

Buffett’s philosophy is simple: never risk being a forced seller. By holding significant cash reserves, Berkshire Hathaway avoids dumping valuable assets at a loss just to pay the bills. This strategy gives them the power to go hunting when everyone else is retreating. In downturns, distressed assets show up like clearance signs at an outlet mall. But if you’re fully invested, all you can do is watch.

For creators, entrepreneurs, or anyone building long-term—this logic applies. Holding some dry powder doesn’t mean you’ve given up on growth. It means you’re ready to act when opportunity shows up wearing a discount tag.

“It takes 20 years to build a reputation and five minutes to ruin it.” Warren Buffett doesn’t toss out phrases like that for effect. Reputation, for him, isn’t soft—it’s structural. It’s the difference between doing one deal and being trusted with hundreds. At the core of his business philosophy is integrity. Not the version that looks good in a company mission statement but the kind that quietly guides decisions when no one’s watching.

Buffett has always played the long game. He knows that trust compounds like capital—slow at first, but powerful over time. When investors believe in your word, regulations get easier, partnerships go smoother, and opportunities tend to find you. He’s built Berkshire Hathaway not just with good bets, but with a near-fanatical commitment to honesty. When mistakes happen—and they do—the way he owns them reinforces that trust instead of draining it.

In an era obsessed with speed, Buffett’s philosophy is a reminder: fast growth is nice, but lasting credibility is better. For creators, founders, or investors—the message is the same. Build a reputation carefully. Guard it like an asset. Because it is one.

You don’t need to be Warren Buffett to make smart moves—you just need to think like him. The tools and market access available today give regular people a shot at long-term wins, but only if they ignore the noise. Buffett’s approach? Simple: only invest in what you understand, buy underappreciated value, and hold tight.

In a world obsessed with flash—crypto spikes, meme stocks, viral side hustles—this mindset feels outdated. But that’s the point. Boring works. Clear thinking and patience win when the hype fades and fundamentals take over. If your portfolio makes you yawn a little, that’s often a good sign.

Stick to what you know. Keep it simple. Let time do the heavy lifting.