Introduction

Vlogging has taken punches from every direction—algorithm shifts, ad revenue changes, new platforms stealing attention—but it keeps standing. Creators who’ve been at this for years know the drill: adapt or fade. During the chaos of the past few years, many vloggers leaned into what they do best—building trust. While shiny trends came and went, consistency, relatability, and community built staying power.

Now, 2024 is changing the terrain again. The demand for authentic content hasn’t disappeared, but how it’s delivered, discovered, and monetized is transforming fast. Algorithms are evolving. AI is changing the workload. And audiences, while still hungry for entertainment, are asking for more depth and more relevance. It’s not about having the most polished output anymore—it’s about showing up in a way that feels real and offers actual value.

If you’re creating today, understanding these shifts isn’t optional. It’s how you survive—and thrive—on platforms that never stop moving.

Market Trends Investors Are Watching in 2024

Technology is still holding the crown, but the hype cycle is settling. Big growth? Still there. But investors are getting pickier—backing companies that show more strength in execution than buzz. It’s not about who’s loudest in AI anymore; it’s who’s building something that actually scales.

Energy and commodities are back in sharper focus. Inflation isn’t done yet, and global demand patterns are shifting fast. Sectors like lithium, oil, and natural gas are being re-priced through a geopolitical lens. Winners here aren’t just riding the commodity wave—they’re managing volatility better than the rest.

In healthcare, regulation is no longer the main story. Innovation is. From precision medicine to wearable diagnostics, the money is following breakthroughs. It’s not just about blockbuster drugs either—the convergence of data, devices, and delivery is drawing serious capital.

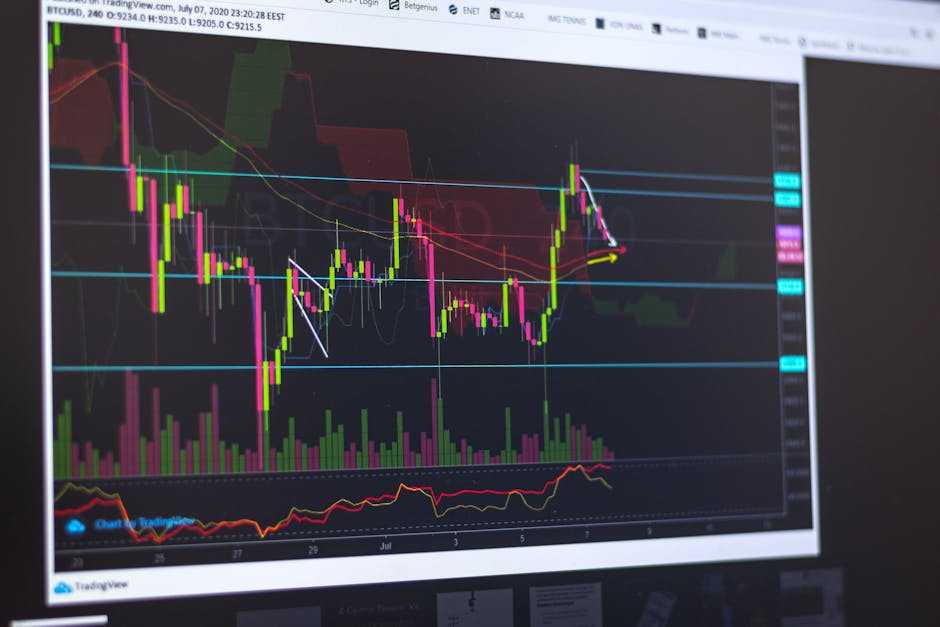

Digital assets? Split views. Institutional money hasn’t left, but it’s more intentional. The wild swings are out; selective conviction is in. The savvy play here isn’t betting on coins—it’s watching the infrastructure quietly being built behind the scenes.

2024 is less about chasing trends and more about understanding them. Smart money is staying curious, but cautious.

Active Investing Isn’t Dead—It’s Adapting

In 2024, smart money is on the move. Passive investing still plays its part, but the tidal wave of global volatility—from inflation swings to geopolitical frictions—has pushed institutional and retail players alike to stay nimble. Active bets are back in rotation, not because managers suddenly crave complexity, but because standing still means bleeding return.

Hedging strategies are getting sharper, too. From currency risk to supply chain shocks, global uncertainty is forcing creators of capital to think beyond broad indexes. Flexibility is the new alpha, and that’s where liquidity and scalability come in. Funds want assets that can move fast without slippage, scale up without breaking, and exit without drama.

And while quant models still rule the risk-parity roost, a point of caution: the models aren’t immune to noise. Some are evolving to distinguish signal from Rorschach; others are just overfitting the chaos. In this climate, an edge depends less on code and more on judgment. The best players blend data with discretion and move before the dashboards flash red.

Hedge Fund Lessons Every Retail Investor Should Know

When it comes to generating consistent returns, hedge funds operate with a level of strategy and discipline that most individual investors overlook. While everyday retail investors don’t have access to the same tools or capital, many of the principles behind successful hedge fund strategies are surprisingly adaptable on a smaller scale.

Learn From the Pros: Hedge Fund-Inspired Takeaways

Retail investors can apply several key practices of hedge funds to elevate their approach:

-

Risk Management is Non-Negotiable

Hedge funds don’t just aim for high returns—they play strong defense. Setting stop-loss limits, diversifying across asset classes, and balancing high- and low-risk plays are standard practices. -

Thesis-Driven Investing

Instead of following hype or headlines, hedge fund managers develop well-researched investment theses. Retail investors should focus on understanding the “why” behind every position they take. -

Data and Discipline Over Emotion

Decisions are driven by analysis and objective indicators—not speculation or fear of missing out.

Sectors Worth Watching

Rather than chasing the latest trend, smart investors analyze macro shifts and industry fundamentals. In 2024, keep a close eye on:

- Energy transition technologies (e.g., battery storage, green hydrogen)

- Cybersecurity and AI infrastructure

- Resilient consumer sectors, especially in budget and discount retail

Sectors to Approach with Caution

Avoid jumping into sectors solely because they’re making headlines:

- Speculative tech plays without revenue

- Overhyped IPOs in unproven markets

- Short-term crypto trends with little utility

These areas can be volatile and often lack the fundamentals to justify long-term investment.

Timing, Patience, and Adaptability

One of the most overlooked elements of hedge fund strategy is timing—not timing the market, but knowing when to act.

- Patience pays: The best investors often wait weeks or months for the right setup.

- Adapt fast: Don’t marry a thesis. Be ready to pivot based on new data.

- Review regularly: Hedge funds constantly reassess their positions—retail investors should too.

In a market where conditions shift rapidly, those who blend strategic thinking with long-term discipline are the most resilient. The lesson? Think like a hedge fund, even if you invest like a retail trader.

Why Select Hedge Funds Are Leaning Into Crypto

Not all hedge funds are jumping on the crypto bandwagon—but the ones that matter are moving quietly and deliberately. These are the firms with long-game thinking, the ones that aren’t interested in riding hype waves. They’re betting on crypto because they’re seeing something beyond Twitter cycles: real infrastructure, advanced custody solutions, and an evolving regulatory environment that doesn’t look quite as Wild West as it did three years ago.

The shift isn’t about Bitcoin moonshots. It’s about programmable assets, decentralized finance, and blockchain’s potential in clearing and settlement. Hedge funds are zeroing in on areas where blockchain offers speed and cost advantages—like bypassing third parties, reducing reconciliation friction, and adding transparency to illiquid markets.

Sorting the signals from the noise is key. Legacy coins and meme tokens aren’t the main draw here. It’s smart contract platforms, interoperability protocols, and tokenized real-world assets that are pulling in institutional capital.

For those wondering where this all leads, here’s a clue: the funds that once specialized in distressed debt or frontier markets are now quietly hiring blockchain analysts. Not hype. No press. Just calculated exposure to a system that might rewrite the pipes of global finance.

Explore more: Why Top Fintech Experts Believe Digital Currencies Are the Future

Smart Money Isn’t Static—It Evolves

The New Rules of Financial Agility

In an unpredictable landscape, one thing is clear: smart money never sits still. Whether you’re a creator reinvesting in your business, or a seasoned investor navigating volatile markets, the financial edge has shifted. Success now depends less on rigid strategy, and more on adaptive decision-making.

- Traditional approaches alone won’t cut it

- Flexibility and real-time awareness matter more than ever

- Smart money follows momentum—but also knows when to pause

The Modern Edge: Data, Discipline, and Agility

Today’s financial winners aren’t just lucky—they’re informed, focused, and nimble. These are the traits that separate reactive players from long-term strategists.

- Data: Use insights to understand trends before they go mainstream

- Discipline: Stick to plans, but know when to pivot with purpose

- Agility: Be ready to adjust in real time without losing sight of the bigger picture

Tactical, Not Trendy

In a world flooded with hot takes and speculative hype, skepticism is your greatest ally. Smart money isn’t about chasing the latest trend—it’s about calculated moves based on clear reasoning.

- Stay informed, but avoid noise

- Ask: “What’s the downside I’m not seeing?”

- Be tactical with every dollar, every decision

Bottom line: Smart money isn’t just evolving—it’s learning faster. Stay sharp, make agile moves, and approach every opportunity with clarity and caution.