Charts aren’t just for analysts and day traders—they’re essential for any investor who wants to make decisions with eyes wide open. Whether you’re swinging for a quick gain or holding long-term, understanding price trends, volume spikes, and key levels helps cut through the noise. At a glance, a chart shows you what the market has actually done, not what headlines or hype might suggest.

Timing matters. A visual snapshot of recent price action often reveals patterns the naked eye misses. Breakouts, pullbacks, consolidation zones—recognize these, and you can sharpen your entries and exits. It’s not about predicting the future. It’s about increasing your odds by following data you can see.

When emotions kick in—when fear creeps up during a market dip or when greed whispers that you’re missing out—a chart brings you back to earth. It’s an anchor. Instead of reacting to panic or excitement, you look at support levels, trend lines, momentum indicators. You make decisions grounded in reality. That’s how better calls get made.

Understanding stock charts isn’t just for Wall Street types with six monitors and a Wall Street Journal subscription. If you’re vlogging about finance, investing, or even crypto, you need to know the basics.

Start with the ticker symbol—it’s the short code that represents the asset. Think TSLA for Tesla or AAPL for Apple. Simple, but crucial. Next, pay attention to the time frame. A chart showing one-minute intervals tells a very different story than one showing monthly movements. Choose based on the story you’re trying to tell: intraday trading vs. long-term investing.

Then there’s the price axis—the vertical one. It shows the value change over time. Don’t just glance at the highs and lows. Look at how steep the changes are. Fast drops or spikes signal volatility, which can be an opportunity or a red flag, depending on your angle.

Volume bars often sit beneath the main chart. More volume? More people are trading. It doesn’t always mean a price will move, but it does mean something’s getting attention. Just don’t rely on volume alone—it’s a clue, not a confirmation.

As for chart types: line charts are clean and ideal for overviews. Great for storytelling. Candlestick charts, though? They’re meatier. They show a stock’s open, close, high, and low in one compact visual. Use line charts when keeping it simple. Go with candles when you want to dig into trading behavior and momentum.

Bottom line: match the chart format and details to the story you’re telling. And always know what each element actually means before tossing it into your video.

Anatomy of a Candle: Reading the Market One Body at a Time

Candlestick charts are the bread and butter of any visual trader. Each candle packs four key pieces of data: the opening price (where it all started), the high (top price hit within that period), the low (bottom price hit), and the closing price (where it ended). Open-high-low-close—or OHLC—is how traders read the emotion baked into the price movement.

Then come the patterns. A doji shows indecision—buyers and sellers balanced at a standstill. A hammer hints at a potential upward reversal, especially after a nosedive. Engulfing patterns (where one candle completely wraps over the one before it) indicate power shifts. A bullish engulfing says buyers just took control; bearish means sellers are swinging back.

These shapes aren’t magic. But they leave clues. A cluster of reversal candles at key price levels can signal a trend change. Momentum builds not just in direction, but in how reluctant or hard-fought that movement is. Candlestick patterns help you see that tug-of-war, frame by frame.

Technical indicators can feel like noise if you don’t know what you’re looking at—but when used right, they act like a compass for vloggers trying to ride algorithmic waves rather than crash against them.

Moving Averages are your first line of sight. They help filter out the day-to-day volatility and show you longer-term trends. Think of them as the radar line on your vlogging strategy chart—it smooths the chaos. A bump above or below a commonly used MA (like the 50 or 200-day) can signal a breakout or a burnout.

RSI, or Relative Strength Index, adds another layer. Overbought? You might’ve pushed your content angle too hard, or your niche is saturated. Oversold? That could be a signal to lean in, especially if your views dipped but engagement stayed steady. Use RSI to assess whether you’re forcing it—or striking gold before it hits the mainstream.

MACD is all about momentum and confirmation. You’ll want that MACD line to cross above the signal line to feel confident the trend is real. It’s not about guessing—you’re looking for alignment. When your follower growth starts picking up and your MACD backs it, it’s a good time to lean harder into what’s working.

Support and Resistance aren’t just Wall Street lingo—they apply to creators too. Support is where your audience keeps you afloat (that core content they always show up for). Resistance? That ceiling you hit when views plateau or new viewers bounce. Break past resistance with a smart format twist or a strong collab. Fall below support too often, and it’s time to rework your game.

These tools don’t guarantee virality. But they do give data-driven creators a way to read the room—and react without just guessing.

Understanding Content Trends: Peaks, Valleys, and Plateaus

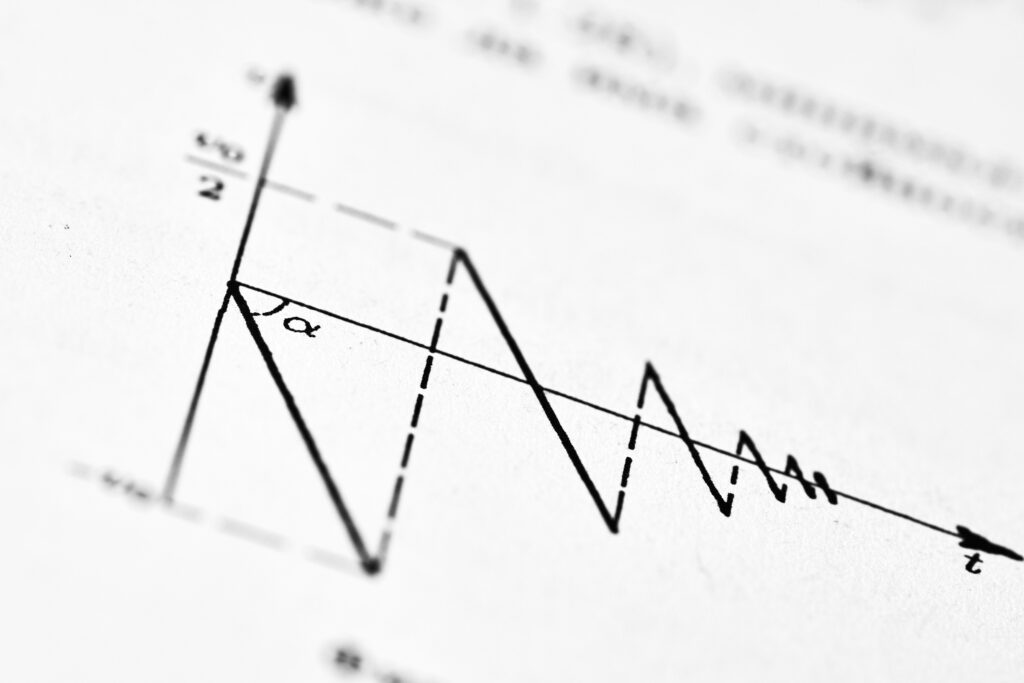

To keep your vlogging momentum strong, you need to recognize how content performance actually behaves. Not every rise is a rocket, and not every dip is a disaster. Think of your analytics like a chart: uptrends, downtrends, and sideways action all tell a story.

An uptrend is when views, engagement, and growth consistently push higher over time. It might be gradual, but it’s sustainable. Downtrends, on the other hand, aren’t always failures—sometimes they’re signals to pivot or rest. Sideways trends—nothing much rising or falling—can mean your content is solid but missing a push or tweak.

The trap? Chasing spikes. Viral moments feel good, but they burn out quick and often leave creators scrambling to replicate one-hit success. Building for momentary bursts instead of long-haul value is how channels flatten out or burn out.

The better approach: zoom out. Day-by-day stats can distract. Look at your performance weekly, even monthly. Are things progressing? Does the line bend upward over time? That long view keeps you grounded, and helps you make smarter decisions without constant panic or ego boosts.

Content trends aren’t just numbers—they’re signals. Learn to read them calmly, and you’ll adapt faster than most.

Don’t Read Charts in a Vacuum—Follow Bigger Sector Movements

Charts tell a story, but not the whole one. If you’re only reading technicals without checking what’s happening sector-wide, you’re missing context—and potentially setting yourself up for a false signal. A bullish breakout on a healthcare stock doesn’t mean much if the entire healthcare sector is slumping. Likewise, a weak chart in a surging sector might turn fast once momentum catches up.

The point: always zoom out. Sector trends can either validate your setup or undermine it. Before hitting buy or sell, ask—what’s the broader movement doing? A strong sector tailwind can carry average stocks higher. A sector in decline can drag even the best-performing names down.

For some direction, check out this read on Top 5 Sectors Poised for Growth in the Second Half of 2024. Use macro moves as a compass. Then let the charts fine-tune your timing.

Mastering the metrics behind your vlogging performance isn’t about decoding every spike or dip like a Wall Street analyst. It’s about showing up, tracking trends over time, and learning how to read the story behind the line graphs. Patterns don’t reveal themselves overnight. Be patient—chart reading gets easier the more you review, reflect, and adjust.

Still, don’t fall into the trap of treating analytics like prophecy. Charts are just one part of the equation. A video’s heart—its message, tone, and voice—can’t be captured in a single retention curve or engagement rate.

What works long-term is combining data with context. Look for consistent performance, not just breakout one-offs. Frame numbers with what was happening that week. Did you post at a different time? Was your hook too slow? Were comments more thoughtful—or just quiet? Let context fill in the blanks.

Bottom line: algorithms love consistency, audiences respect clarity, and you’ll make better content decisions when you’re not chasing vanity stats but building on informed, grounded feedback.