Introduction

Vlogging has outlasted every prediction of its downfall. New apps rise and burn out. Formats keep flipping. Attention spans shrink. And still, creators with a camera and a point of view continue to build loyal audiences.

But 2024 isn’t just more of the same. Under the surface, the game is changing. Algorithms are tightening. Viewers are maturing. Speed matters, but so does substance. The creators who survive—and thrive—this next chapter won’t just chase trends. They’ll read patterns, understand what platforms reward, and carve out narrow lanes with wide impact.

This article distills the essential trends of 2024. Not hype, but signal. Not predictions, but pressure points worth understanding if you’re serious about longevity in this space. Let’s zoom out and look at what’s actually shaping the creator economy right now.

Optimism Has a Blueprint: Lessons from Past Booms

Look back far enough and you find a pattern. The post-WWII economic boom, the 1980s tech explosion, and the recovery that followed the 2008 financial crisis didn’t just happen by accident. They were driven by structural forces: disruptive innovation, loose monetary policy, and swelling investor confidence all played their part.

After WWII, the U.S. saw massive industrial output, government investment in infrastructure and education, and the rise of a consumer middle class. In the 1980s, microchips and deregulation unlocked a wave of scalable tech businesses. After 2008, low interest rates and a digital-first economy gave startups room to breathe—and grow fast.

Different decades, same DNA. Innovation sets the fire. Capital stokes it. And when people believe the future might actually be better than the past, the whole system accelerates. That’s the real takeaway—optimism isn’t wishful thinking. It flourishes when smart systems create room for risk, experimentation, and reward.

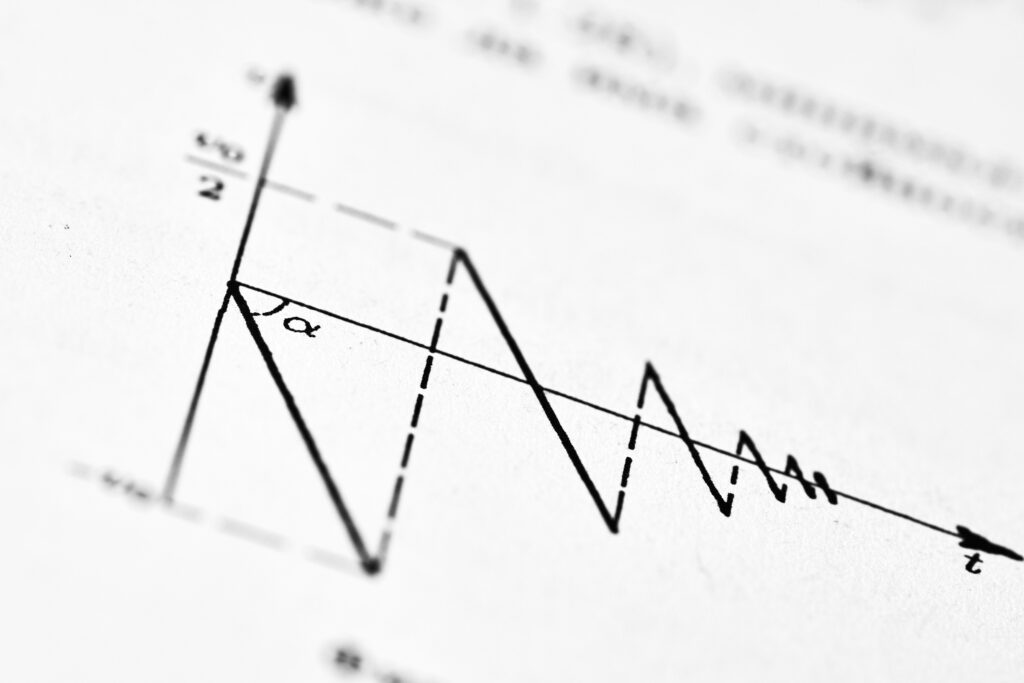

Bull markets and bear markets are two sides of the same coin—both unavoidable, both cyclical. A bullish market is when prices rise steadily, optimism fuels investment, and demand outpaces supply. Think: people buying in anticipation of gains, media buzzing with positive outlooks, and companies expanding. On the flip side, a bearish market is defined by declining prices, shaken confidence, and caution ruling the day. Investors pull back, and fear tends to dominate headlines.

Certain signals tend to show up before each cycle. A bull market often follows periods of economic recovery, falling interest rates, or major policy shifts that favor growth. In contrast, bear markets can be triggered by inflation spikes, geopolitical shocks, tightening monetary policy, or simple overvaluation corrections.

As for duration? That’s less predictable. Bull markets typically outlast bear markets—in modern history, bull runs have lasted several years, while bear downturns are often shorter but sharper. That said, no rulebook exists. Each cycle has its own texture, and timing the market is still more art than science.

Whether you’re investing, creating, or just observing, recognizing these patterns early can save you from getting blindsided—or missing out.

Market Psychology: Greed, Fear, and FOMO on Repeat

The Emotional Core of Market Behavior

Market cycles aren’t just shaped by numbers—they’re driven by human emotion. Behavioral economics shows us that greed during booms, fear during busts, and FOMO during speculative runs are not anomalies—they’re patterns. These emotional drivers are deeply ingrained in how both amateur and professional investors make decisions.

- Greed fuels speculative bubbles and risky bets

- Fear leads to panic selling and hesitation

- FOMO (Fear of Missing Out) pushes investors to buy high, often without a plan

Recognizing these emotions in real time is difficult, yet essential, for every trader or investor looking to stay grounded.

Psychology vs. Fundamentals

While market fundamentals—like earnings, interest rates, and macroeconomic indicators—should guide smart investment decisions, they’re often overshadowed in the short term by crowd psychology.

- Fundamentals explain “why” something should happen

- Psychology often determines “when” and “how violently” it happens

In other words, rational valuation models don’t always hold up against the reality of emotionally driven market swings.

Pattern Recognition Builds Discipline

Just because you can identify the emotional cycle doesn’t mean you’ll avoid the trap. But self-awareness creates a buffer. Understanding that these emotional tides are part of a larger pattern helps shape a long-term strategy built on discipline—not reactive decisions.

- Knowing the cycle helps place your actions in context

- Developing a rules-based approach lowers impulsive choices

- Regular reflection and journaling can reinforce emotional awareness

Bottom line: You can’t eliminate risk or emotion, but recognizing their patterns gives you a significant edge in staying consistent and rational—especially when the markets aren’t.

Crash, Burn, Repeat: What Market History Keeps Teaching Us

The Dotcom bust, the 2008 financial crisis, and the COVID-19 selloff all walked different paths—but they ran over the same nerve. Too much hype, too much money chasing smoke, and then, snap. It’s not just valuation charts that break during a crash—it’s trust. Investors retreat, risk appetite vanishes, and confidence doesn’t always recover on schedule.

Each of these moments started with belief. The web would change commerce (true). Real estate prices could only go up (false). The world would shut down but tech stocks would save us (kind of true, until they didn’t). When the bubble pops, it’s not just about numbers. It’s about people realizing they were all in—and maybe too late.

Rebounds happen. The markets always claw back. But they don’t erase the gut punch. Emotional whiplash follows every boom-bust cycle. Vets get more cautious. New players either double down or drop out. In the aftermath, the survivors aren’t just the ones with reserves. They’re the ones who learn, adjust, and tune out noise when it’s loudest.

Diversification: Why It Matters Even When the Market’s Soaring

When markets are flying high, it’s easy to fall into the trap of thinking everything you touch turns to gold. But that’s exactly when diversification matters most. One hot sector—or one viral content style—won’t stay hot forever. Markets shift. Trends cool off. Algorithms change their minds overnight. If all your creative energy (or investment) is sitting in just one space, the risks stack up fast.

Diversification doesn’t mean jumping ship. It means building a broad base that can flex with the times. Keep your core focus, but add layers—different types of content, multiple distribution platforms, maybe even collabs in adjacent niches. Staying invested in your main thing is smart. Staying blind to new terrain isn’t.

Also, stop hunting for the perfect moment. Timing the market (or a trend) is a guessing game. Time in the game beats timing it. Vloggers who show up week after week, experimenting around the edges while staying true to their voice? They don’t just ride waves—they build staying power. Don’t wait, don’t over-optimize. Diversify and keep moving.

Mindset Matters More Than Market Swings

Markets Will Rise and Fall—Reactions Define You

Markets are unpredictable. Trends surge and fade. Crashes happen. Booms return. What sets successful investors and creators apart isn’t their ability to predict perfectly—it’s how they respond when the tides shift.

- Stay calm when headlines scream panic

- Avoid overcorrecting during downturns or getting reckless in upswings

- Build habits, not just reactions

History: A Guide, Not a Blueprint

While history doesn’t repeat exactly, it rhymes. Looking back helps you spot patterns, but trying to relive or replicate the past often backfires. Use historical context to sharpen your perspective—not to script your every move.

- Use past events to understand market psychology

- Recognize recurring behavioral cycles

- Stay updated, but don’t get stuck in nostalgia

Rationality is a Long-Term Advantage

Tuning out noise and thinking clearly is one of the most underrated skills in any market—whether you’re building content, investing, or launching a product. While others chase hype, your edge is found in staying steady and intentional.

- Follow data, not drama

- Let your values define your strategy

- Reassess, adapt, and stay objective

Award-winning content, distilled. Now it’s your turn—use history to sharpen your edge.

Using historical data isn’t about looking backward just for fun—it’s how smart traders spot what’s coming. Markets tend to repeat patterns, and data helps you catch the early tremors before a move. Think of it less like fortune-telling, more like pattern recognition with decades of evidence behind it.

Start with moving averages. These smooth out day-to-day noise and show you momentum with stripped-down clarity. The 50-day and 200-day are bread-and-butter for spotting trend changes. When the short-term average crosses above—or below—the long-term one, it’s often a signal the tide is turning.

Next, the RSI (Relative Strength Index). This gauges whether a stock or the broader market is overbought or oversold. Staying above 70 too long? Might be overheated. Dropping below 30? Could point to an opportunity.

And don’t overlook market breadth—how many stocks are actually participating in a move. A rising index propped up by just a few giants isn’t solid ground. When most stocks rise together, that’s strength. When most fall while a few big names stay green, be cautious.

Used together, these tools offer more than just hindsight—they give you a lens into potential setups forming right now.

(Read more on this in our guide: How to Read Stock Market Charts – A Guide for Beginners)