Relative Strength Index (RSI)

The Relative Strength Index (RSI) isn’t just a tool for spotting peaks and dips — it’s a window into market psychology. Often misunderstood or oversimplified, a deeper understanding of RSI can give traders and investors an edge, especially when emotions run high.

What Does “Overbought” and “Oversold” Really Mean?

These common terms can be misleading without context. RSI is measured on a scale of 0 to 100 and traditionally:

- Above 70 is considered overbought — potentially signaling that the asset is overpriced and due for a pullback.

- Below 30 is considered oversold — potentially signaling that it’s undervalued and may rebound.

But these thresholds aren’t hard rules. In strong uptrends, RSI can stay overbought for extended periods, and in downtrends, it can remain oversold.

Thresholds Are Flexible – Context is Key

Global events and market sentiment can skew RSI behavior:

- Markets reacting to major news or economic data can push RSI extremes without an imminent reversal.

- RSI signals work best when combined with trend analysis and support/resistance zones.

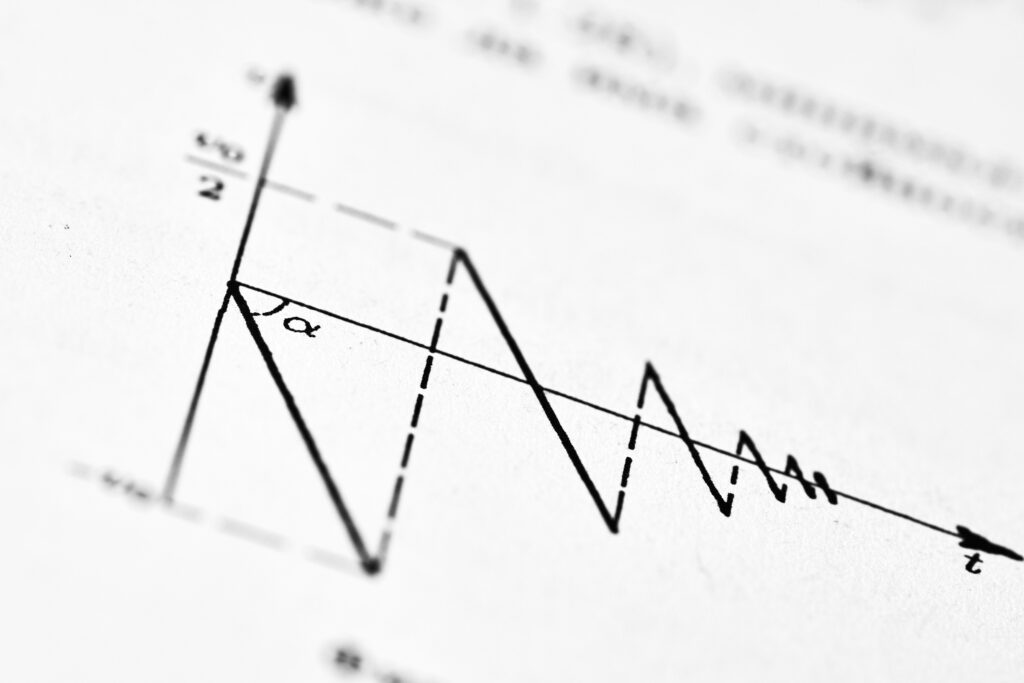

Divergences: A Clue of Shifting Sentiment

Price action and RSI don’t always move in sync — and when they don’t, it’s worth paying attention. RSI divergences often act as an early warning system.

Types of Divergences:

- Bullish Divergence: Price makes lower lows while RSI makes higher lows — a sign that downward momentum is weakening.

- Bearish Divergence: Price makes higher highs while RSI makes lower highs — suggesting upward momentum may be stalling.

Using RSI in conjunction with other indicators (like MACD or volume) can help filter false signals and highlight meaningful sentiment changes.

AI Is Speeding Up Workflow—Without Replacing Humans

Let’s get this out of the way: AI isn’t coming for your vlog. But it’ll gladly help you cut down on time-sucks. Generative tools are already being used by savvy creators to hammer out scripts, research topics faster, and streamline edits. Instead of spending hours chopping footage, creators are leaning on AI-assisted tools to auto-cut dead space, fix color, and drop captions—faster, cleaner, cheaper.

The catch? The human part still matters. Voice, tone, and that hard-to-define spark can get flattened if you hand too much over to the machine. People don’t watch vlogs for faceless optimization—they tune in for you. So while pros use AI to handle the grunt work, they’re keeping creative control where it counts.

Most seasoned vloggers are using a hybrid approach. AI for brainstorming and first drafts. Manual touch for punch-up, punchlines, and polish. Editing tools like Descript and Runway are leading choices, while ChatGPT-style assistants are showing up more in content pipelines. The bottom line: if it buys you more time to be creative, it’s probably worth it.

Learning from the Past: Historical Behavioral Patterns in Market Cycles

Understanding how markets have behaved in previous cycles can help investors make more informed decisions. From the exuberance of bull markets to the cautious sentiment in bear phases, different market environments produce distinct behavioral patterns and indicator responses.

Historical Behavioral Patterns by Market Cycle

Market psychology shifts significantly depending on the overall trend. Here’s how behavior typically unfolds in each cycle:

-

Bull Markets

-

Optimism and overconfidence fuel risk-taking

-

Increased retail participation and momentum trading

-

Higher valuations are justified by future growth expectations

-

Bear Markets

-

Fear and uncertainty dominate

-

Flight to safety: investors seek cash, bonds, or defensive sectors

-

Volatility spikes, and valuations often overshoot to the downside

How Indicators Vary Across Macro Conditions

Key indicators do not exist in a vacuum—they adapt to underlying economic forces and investor behavior.

-

Moving Averages

-

In bull markets: act as strong support bounces

-

In bear markets: often serve as resistance levels

-

Volume Patterns

-

Rising volumes during bullish breakouts indicate strength

-

Increasing volume on down days in bear markets shows growing fear

-

Volatility Index (VIX)

-

Typically low and steady in bull markets

-

Spikes dramatically at the start or during bear phases

Macro Matters: Timing and Sentiment

Indicators don’t behave identically in all market conditions. A moving average crossover or RSI level in a bull market might signal momentum, while in a bear market, the same signals can represent a false rally or short-covering.

- Interpreting signals correctly depends on the macro backdrop

- Investors must be flexible, not formulaic, in their approach

For a Deeper Dive

Explore more in our full analysis: Historical Trends in Bear and Bull Markets: What They Teach Us

Why Market Sentiment Still Matters

Market sentiment moves prices faster than facts. Whether you’re a day trader or a long-term investor, understanding crowd psychology is just as crucial as reading earnings reports. When enough people believe a stock is going up—or down—it often becomes a self-fulfilling prophecy. In short, the market reacts not just to reality, but to the mood around it.

This is where technical indicators come in. Tools like RSI, MACD, and moving averages don’t just track prices—they help reveal what the crowd is feeling. Are traders scared? Greedy? In denial? You won’t find that in a balance sheet, but you can catch it in the charts. Reading these signs isn’t just technical analysis—it’s reading the room.

Price action gives you the what. But sentiment gives you the why. A stock can break resistance out of nowhere, only to fall flat when enthusiasm fades. Learning to ride these waves—not just follow them—is what separates amateurs from pros.

Trust the Tools—But Stay Wary of the Herd

Technical indicators are just that: indicators, not instructions. They’re useful for pattern recognition, decision support, and gut-checking your assumptions. But they don’t replace the human work of judgment. Too many creators and traders alike are leaning on metrics without context, letting dashboards call the shots instead of thinking holistically.

Especially in vlogging—where trends shift fast and platforms don’t explain their moves—data can mislead. Engagement spikes may be the result of algorithmic tests, not actual audience growth. A strong CTR today doesn’t guarantee loyalty tomorrow. Learning to read the signals without surrendering to them is the skill.

When sentiment is mixed or conflicting, risk management has to take the lead. That may mean holding content until the timing’s better, or recalibrating instead of reacting. Following the herd makes creators predictable—and predictable gets tuned out.

Use the tools. But then use your head. That’s how you stay relevant when the noise gets loud.

Track Sentiment, Train Intuition

Understanding market psychology takes more than reading headlines—it’s about actively tracking your own interpretations and learning from them over time. If you’re serious about improving your trading instincts, start by building a process for monitoring how you digest sentiment.

Keep a Sentiment Journal

Journaling isn’t just for price levels and trades. A sentiment journal helps you:

- Log how you perceive market mood: fear, greed, uncertainty, overconfidence

- Note what specific sentiment indicators were saying (VIX, Fear & Greed Index, Twitter sentiment, news headlines)

- Record the general narrative you believed at the time

- Write down the outcomes: Did the market behave as expected? Were you too reactive or too cautious?

This exercise will begin to reveal your own biases and patterns of over- or underreaction.

Develop Market Psychology Intuition

Over time, this journal becomes more than a log—it becomes a tool to sharpen your instincts.

Key benefits:

- Spot recurring emotional or narrative traps you fall into

- Recognize when the crowd is swinging too far in one direction

- Differentiate between valid sentiment shifts and noise

The best traders aren’t immune to emotion—they’ve just trained over time to understand how it influences behavior, both theirs and the market’s.

With consistent practice, you’ll start recognizing emotional extremes before the market reacts. That’s when sentiment becomes a true edge.