Why Smart Sector Rotation Matters in a Volatile Climate

In an environment where markets swing on headlines and rate hikes, sector rotation isn’t just a tactic—it’s survival strategy. Smart investors aren’t parking capital in yesterday’s winners. Instead, they’re shifting between sectors based on where growth is heating up, and where risk is cooling down.

Macroeconomic signals are starting to point toward uneven—but real—economic momentum. Resilient consumer spending, cooling inflation, and the potential soft landing many wrote off a year ago have tilted investor attention toward sectors tied to cyclical growth—think industrials, tech recovery plays, and selective retail. Meanwhile, defensive sectors like utilities and staples are being used tactically, not habitually.

More importantly, investors are trading passive reactions for strategic allocation. That means watching leading indicators, sifting through earnings guidance trends, and staying nimble. The goal now isn’t just to stay afloat—it’s to pivot fast enough to ride the upside. It’s chess, not checkers.

AI Is Speeding Up Workflow—Without Replacing Humans

Generative AI isn’t hype anymore—it’s impact. Vloggers are using AI tools to automate the slog: rough cuts, transcription, voiceovers, even thumbnail generation. What took hours now takes minutes. But here’s the kicker: the best channels aren’t trying to fully automate the personality. They use AI to save time, not to replace their point of view.

Semiconductors, often overlooked in creator circles, are making a comeback. After a shaky 2023, hardware suppliers are stabilizing. That’s good news—because smoother production pipelines mean more reliable gear, faster chips, and ultimately, better tools in creators’ hands.

Add to that the return of predictable supply chains, and you’ve got potential margin swings in gear pricing and availability. For creators shooting in 4K, livestreaming in real time, or pushing out daily edits, this backend recovery actually matters.

One more thing: Don’t just track the AI apps—watch the hardware enablers. Companies making GPUs, sensors, SSDs—they’re the quiet players powering the tools we all lean on. Software is loud, but hardware backs it up.

Healthtech’s Long-Term Momentum

A Long Runway: Aging Population Meets Personalized Care

Healthcare innovation is riding powerful demographic and technological waves. The global population is aging, and with that comes increased demand for smarter, more tailored medical solutions. This isn’t a short-term trend—it’s a decades-long shift that healthtech is well-positioned to serve.

- Increased life expectancy drives ongoing healthcare demand

- Personalized care models are moving from concept to mainstream adoption

- Seniors are embracing tech, opening new markets for digital health tools

A Shift in Tools: From Wearables to AI-Driven Diagnostics

The healthtech stack is evolving fast. Devices and platforms that once sounded futuristic are now essential.

- Wearables are enabling real-time biometric monitoring and wellness insights

- Remote care solutions are reinventing how patients access treatment, especially post-pandemic

- AI diagnostics are streamlining and enhancing accuracy in clinical assessments

These tools are not only improving outcomes—they’re reducing healthcare costs and expanding access.

Biotech + Healthtech: The Innovation Pipeline Heats Up

Biotechnology breakthroughs are accelerating, and many lie at the intersection of software and biological sciences.

- Genetic editing tools and personalized therapies are advancing rapidly

- AI is helping accelerate drug discovery and diagnostics

- Assistive robotics and neurotech are emerging growth areas

The convergence of healthtech and biotech promises a fertile ground for both scientific progress and investor interest.

Risk & Reward: Smart Diversification is Key

With rapid innovation comes high variability in success. Investing in individual companies based solely on hype can be risky, but strategically spreading exposure across trials, platforms, and tools helps mitigate that.

- Focus on diversified funds or ETFs that capture broad exposure across digital health and biotech

- Monitor clinical trial pipelines and FDA approval timelines

- Weigh potential breakthroughs against regulatory and reimbursement risks

The healthtech arena may be volatile in the short term, but its long-term prospects are among the most compelling of any innovation sector.

Governments are finally putting their money where the climate promises are. Across North America, Europe, and parts of Asia, policy momentum is translating into real incentives: tax credits for clean energy developers, ESG mandates that are actually enforceable, and global targets that no longer feel like vague aspirations. This means renewables are no longer a fringe bet—they’re an investment lane with a long stretch of green lights ahead.

Solar and wind are still the backbone, but the next wave is in EV infrastructure, energy storage, and smart grid tech. These aren’t just buzzwords anymore; they’re capital-ready sectors drawing funding from both public and private pools. The standouts? Grid-scale battery firms, EV charging network providers, and modular solar systems aimed at urban rooftops.

Of course, the field is crowded. Established players like Tesla, NextEra, and Siemens are flexing scale advantages, but scrappy newcomers are carving niches by moving faster or solving the smaller, overlooked problems. In this space, innovation might beat pedigree.

Investors and creators alike should watch the tension between demand resilience and fossil volatility. Clean tech isn’t just cleaner—it’s starting to look more stable in terms of cost, supply chain, and political risk. In a world of wild price swings and climate disruption, that’s a value proposition even old-school markets are beginning to respect.

Spending Is Up—But Choose Your Lane Carefully

Consumers are still opening their wallets, especially when it comes to experiences. Travel, entertainment, and lifestyle-focused content are grabbing attention—and dollars. Streaming platforms, digital-first events, and brands tied to leisure and self-expression are outperforming traditional retail plays. For vloggers, that means alignment with these sectors could unlock new monetization paths, from brand partnerships to direct-to-audience offers.

The numbers support it: even after adjusting for inflation, spending in these areas is strong. Audience appetite isn’t just returning—it’s evolving. People want real, valuable moments, not more stuff. If your content rides alongside aspirational but accessible lifestyle trends, you’re in the green zone.

That said, there’s a caution flag. Some companies chasing growth are stacking debt to stay afloat. Vloggers who partner with sponsors or platforms should do a quick financial gut-check. If a brand seems flashy but thin on fundamentals, think twice. Longevity matters—on both sides of the camera.

Why Monitoring Real-Time Supply and Demand Matters

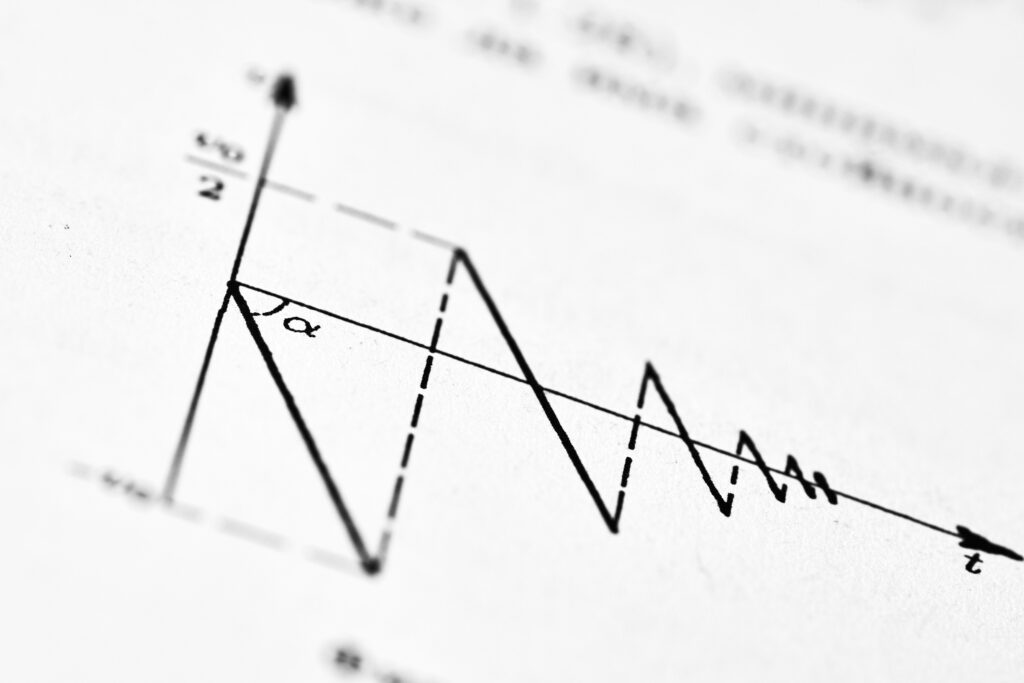

Understanding market direction begins with reading supply and demand in real time. Many retail traders look only at lagging indicators or headlines, often missing the powerful clues that emerge from immediate price and volume activity.

Watching Supply and Demand in Action

Markets are dynamic and fast-moving. Real-time activity offers context that can’t be captured in static charts or post-facto commentary. By tracking shifts in trading volume, price movement, and order flow, traders can:

- Identify active buying or selling pressure

- Spot potential reversals or breakouts before they hit the news

- Gauge liquidity and volatility across assets

Consistent monitoring sharpens timing, especially for swing traders and active investors who rely on precision.

Early Clues: Sector-Based ETF Flows and Volume Spikes

While individual stock moves are important, sector-based ETFs act as a broader barometer of institutional positioning. When capital flows rapidly into (or out of) an entire sector, it can signal momentum shifts that individual stock charts haven’t yet reflected.

Key indicators to monitor:

- Volume anomalies in sector ETFs such as XLF (Financials), XLV (Health Care), or XLK (Technology)

- Unusual options activity tied to sector momentum

- Rate of change (ROC) in ETF flows over short timeframes (e.g., 1 or 5 days)

Volume surges in ETFs often precede or coincide with significant news or macro rotations—giving savvy traders early entry points or time to sidestep risk.

Learn More:

For a deeper dive on reading supply and demand mechanics in the market, visit: Understanding Supply and Demand Signals in the Stock Market

Federal infrastructure dollars are finally moving from paper to pavement. Projects delayed during planning stages are now breaking ground across states, creating a ripple effect that’s boosting demand in construction materials, automation hardware, and logistics tech. Cement, steel, and semiconductors are hot again—but so are robotics, project management tools, and sensors.

Companies that serve these sectors are seeing a steady tailwind, and it’s more than just a short-term spike. Electrification—think EV chargers, grid upgrades, renewable integration—and resiliency planning are now built into most public works budgets. That locks in long-term capital flows, especially for firms with hardware or software that solves fragmentation in construction and energy.

An overlooked kicker? Reshoring. More manufacturing is coming back to domestic soil, largely driven by supply chain lessons from the past few years. As infrastructure builds catch up to that demand, it’s not just about roads and bridges—it’s about rebuilding the industrial backbone of the U.S. Creators who track, explain, or visually document this transformation will find an emerging content space with depth and momentum.

Don’t Chase Trends—Understand the Fundamentals

In a content landscape obsessed with trends, it’s tempting to jump on the latest format, challenge, or viral sound. But savvy vloggers know better. Trends are fleeting. Fundamentals—like knowing your audience, refining your storytelling, and delivering actual value—are what build lasting relevance.

This year’s shifts reward those who can read the wider signals: platform algorithm changes, creator monetization policy updates, and evolving viewer habits. These are the real catalysts. Missing them because you were busy copying whatever’s hot this week? That’s a losing trade.

Also, know what kind of creator you are. Do you thrive on volume? Depth? Niche authority? Understanding your risk tolerance helps you choose which ideas to go all-in on, and which to skip. Trying to hit everything dilutes both your voice and your time.

The growth is still here. But the impulsive, the copycats, and the unprepared are getting left behind. The future favors creators who stay sharp, stay lean, and know why they’re doing what they’re doing.