What Technical Indicators Actually Do

In a fast paced, emotionally charged market, technical indicators serve as a trader’s compass. They filter out the daily noise of price movements and provide a clearer picture of where the market might be headed.

Cutting Through the Noise

Price fluctuations can be chaotic, driven by speculation, headlines, or panic. Without context, it’s easy to misread the movement. Technical indicators help traders:

Remove emotional bias from trading decisions

Focus on patterns and momentum, not just price points

Understand whether a trend is real or just noise

Timing Entries and Exits

One of the biggest challenges in trading? Knowing when to get in and when to get out. Indicators play a key role in:

Identifying possible entry points based on historical price behavior

Timing exits to lock in gains or cut losses

Avoiding premature decisions based on impulse

Confirming Trends and Spotting Reversals

Indicators don’t just look backward they offer clues about what’s next:

Confirm a market’s trend direction before committing capital

Detect early signals of a potential reversal

Strengthen confidence in trades based on multiple aligned indicators

Used correctly, technical indicators help remove guesswork. They give traders a data driven edge if they know how to read the signs.

Core Indicators That Matter

When it comes to reading market behavior with clarity, a few technical indicators stand out. You don’t need a dozen charts open just smart tools and the discipline to use them right.

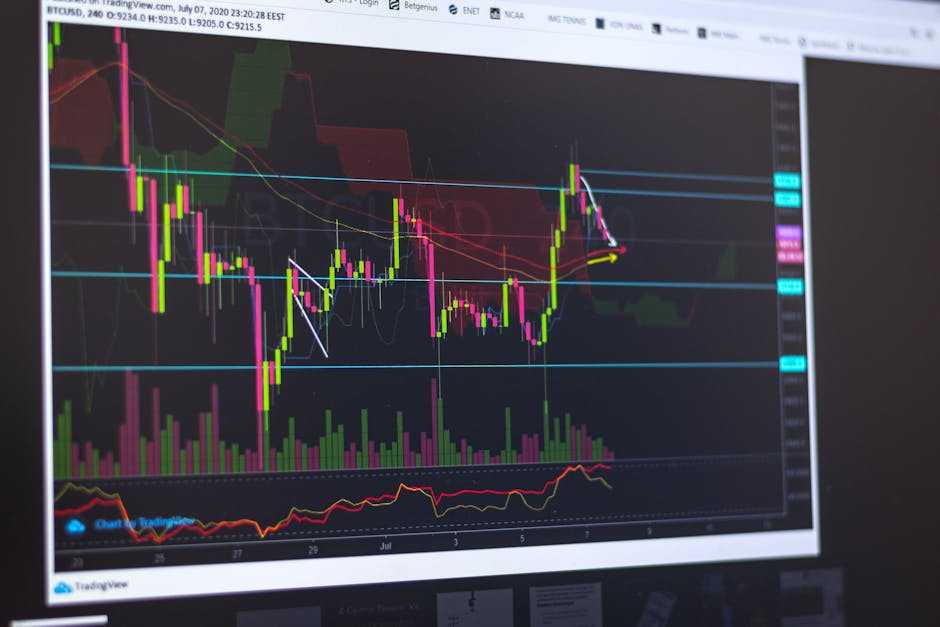

Moving Averages (MA) are the backbone of trend analysis. The simple moving average (SMA) or exponential moving average (EMA) help you see through the day to day noise. A short term MA (like the 20 day) can highlight momentum, while longer term ones (50 day, 200 day) signal major trend direction. When short crosses above the long, it’s often a sign of upward momentum; cross below, and sellers might be winning.

Relative Strength Index (RSI) gives a read on whether a stock or market is overbought or oversold. It’s scaled from 0 to 100. Over 70 suggests heat buyers may be getting greedy. Under 30? That may be panic selling. RSI won’t predict a reversal alone, but paired with trend signals, it helps.

MACD (Moving Average Convergence Divergence) is your go to for momentum strength. It shows the relationship between two EMAs usually the 12 day and 26 day. When the MACD line crosses above the Signal line, it’s often a bullish move. Below it? Think caution. What matters most is the direction and spacing it tells you if a trend is gaining muscle or losing steam.

Bollinger Bands wrap around price action and flex with volatility. When the bands expand, the market’s getting jumpy. A price move near the upper or lower band can signal a breakout or a fakeout. Don’t rely on them alone. But as part of a bigger picture, they show where pressure’s building.

Each of these tools tells a part of the story. Combined, they help you stay sharp, act with purpose, and avoid getting caught in emotion driven trades.

Reading Trends the Right Way

When it comes to interpreting technical indicators, context is everything. A single indicator rarely gives the full picture smart traders cross reference multiple tools to get a clearer read on market direction.

Don’t Rely on a Single Signal

Basing a trade decision solely on one indicator is a common pitfall. Markets are influenced by numerous factors, and no single metric can capture all of them.

One indicator = partial insight

Over reliance leads to false signals and mistimed trades

Cross verifying signals helps reduce noise and false positives

The Power of Confirmation: Combine for Clarity

Combining indicators increases your chances of identifying reliable trends. For instance, pairing momentum indicators with trend following tools can strengthen your signal.

Use a Moving Average to identify trend direction

Confirm with RSI or MACD to gauge momentum

Watch for alignment across indicators before entering a trade

Volume as the Final Filter

Volume is a crucial element often overlooked. Without volume confirmation, price action can be misleading.

A breakout without volume? Likely a trap

Rising volume = stronger conviction behind price movement

Use volume spikes to validate breakout or reversal patterns

For a deeper breakdown of charts and timing, explore this guide: market chart reading guide

Real World Use: How Traders Apply Indicators Today

Technical indicators aren’t just for textbook theory they’re part of the daily toolkit for different types of traders, each with their own pace and priorities.

Swing traders live for confirmation. They’re not jumping in and out every hour; instead, they want assurance that a trend is real before they commit. That might mean waiting for a moving average crossover, or using RSI to spot a confirmed bounce. Patience, with precision.

Day traders, on the other hand, move fast. They rely on momentum indicators like MACD or RSI to spot quick setups and validate on the go decisions. They don’t need a long story just a signal they can trust and act on before the window closes.

Then there are long term investors. For them, it’s less about timing every swing and more about identifying solid entry points. They often lean on moving averages to smooth out noise and signal when a stock is reasonably valued or poised to trend upward.

No matter the strategy, indicators help translate market chaos into clarity provided you use the right ones for the job.

Wrap Up: Why It All Comes Down to Discipline

Indicators Are Not Crystal Balls

Technical indicators are powerful tools, but they’re not foolproof. They don’t predict the market they help interpret it. Relying solely on any one indicator can lead to false confidence or missed opportunities.

Indicators are based on historical data and patterns

They highlight probabilities, not certainties

Smart traders use them as part of a broader strategy

Consistency Beats Instinct

In the fast moving world of trading, gut feelings can be tempting but usually costly. Discipline and consistency in how you use indicators can make the difference between long term success and emotional missteps.

Stick to your strategy, even during volatility

Avoid knee jerk decisions based on daily noise

Review your performance and adjust thoughtfully

Stay Data Driven

Emotion is the enemy of good trading. Indicators thrive when they’re paired with rational analysis. Let the charts and signals guide you not the fear of missing out.

Always let data inform your decisions

Avoid overtrading just to stay active

Know when to sit back and wait for the right setup

Pro Tip: Couple trusted indicators with solid chart reading habits to enhance your edge. Start sharpening your skills here: market chart reading guide