Market Signals That Still Matter

Markets may have evolved, but certain signals still carry weight if you know what to look for. The P/E ratio remains a solid, if sometimes misunderstood, gauge of market sentiment. It’s not perfect, but when price vastly outpaces earnings, it’s usually a red flag. Same goes for the yield curve: when short term rates creep above long term ones, a recession has historically followed. Maybe not right away, but the warning is rarely empty. GDP trends, too, offer ground truth. Slowing growth or a shrinking economy doesn’t lie, even when earnings reports try to spin a different story.

That said, not every signal is hitting like it used to. In the post COVID, stimulus soaked era, some investors have learned to ignore inverted yield curves. They do so at their own risk. The 2022 inversion, for example, came early but still flagged a rough patch ahead. P/E ratios in tech? Often sky high and somehow still climbing. Without real earnings to back them, those skyward valuations eventually test gravity.

The bottom line? Abandoning these time tested indicators isn’t bold it’s blind. True, markets shift and nuance matters. But when you stop checking your dashboard entirely, don’t be surprised when you miss the turnoff and hit a wall.

Data Driven Sentiment Tracking

Markets don’t move on logic alone. They move on fear, greed, optimism, and panic all packaged as sentiment. When investors collectively lean too far in one direction, it tips the balance. We’ve seen this unfold in meme stock rallies, crypto winters, and pandemic era crashes. One shift in mood and the market moves with it.

Institutional investors usually act first. They have models, teams, and playbooks built on macro and micro signals. Retail follows but not always smartly. When retail euphoria hits highs (think record Robinhood downloads), institutional money often quietly exits. Understanding who’s acting, and why, can signal what happens next.

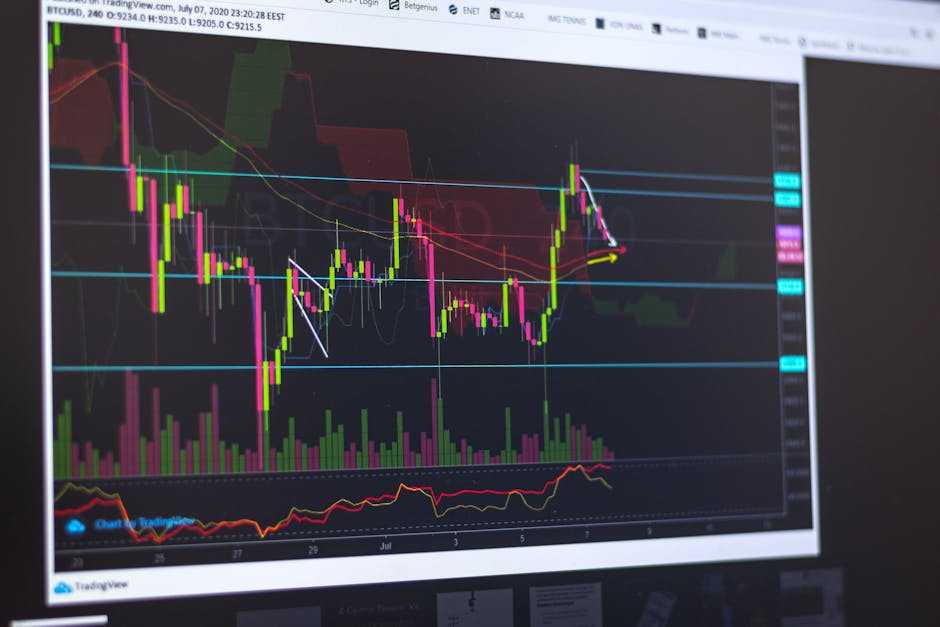

The tools to stay ahead aren’t secret. Keep an eye on volatility indexes (like the VIX), analyze options flow, and watch fund inflows and outflows. Social sentiment tools are getting sharper, using AI to track investor mood across Reddit, Twitter, even Discord. Knowing when the crowd is too bullish or too scared can help you zig when others zag.

For a longer view on how sentiment shaped previous market cycles, look at this historical bull and bear markets deep dive.

The Fed, Inflation, and Policy Pressure

Rate hikes (and pauses) aren’t just background noise anymore they’re market shaping events. The Federal Reserve’s recent moves may be setting up for a different kind of 2026. If current signals hold, we’re seeing a slow shift from tightening to a potential neutral or even easing stance. That pivot, even hinted at, has major consequences. For bulls, it’s fuel. For bears, it’s a warning that markets may have priced in too much too fast.

Inflation, while cooled from its 2022 peak, is still sticky in some sectors. The direction it takes in the next 12 18 months will either support ongoing growth or reintroduce volatility. If inflation falls in line with the Fed’s target, momentum stays upward. If it reignites especially with consumer prices or wages creeping back expect fast sentiment flips.

Then there’s fiscal policy. In an election cycle, government spending and tax policy start casting long shadows. Budgetary choices in 2024 and 2025 will influence everything from infrastructure stocks to healthcare plays. Investors watching markets in isolation will miss a key part of the picture. Big capital flows now follow both central bank whispers and Capitol Hill intentions. The blend of fiscal and monetary policy could very well define the market mood leading into 2026.

Tech & Sector Volatility as Early Clues

Big tech has a knack for distorting the bigger picture. When a handful of massive names think trillion dollar market caps rally hard, they can pull indexes into the green even as the majority of stocks tread water or sink. That skews traditional sentiment indicators and makes it tough for investors to read the true state of the market. Watching the equal weighted indices or sector specific performance gives a clearer sense of where momentum is or isn’t building.

Sector rotation is another early clue. Money flows from one industry to another in anticipation of economic shifts. When defensive sectors like utilities or consumer staples start outperforming growth sectors, it may be a warning that investors are bracing for impact. On the flip side, renewed interest in risk on sectors like semiconductors or emerging tech can validate a bullish shift.

Meanwhile, energy, biotech, and AI linked equities bring risk and opportunity in sharp relief. Energy stocks swing on oil prices and geopolitics. Biotech runs on FDA approvals and binary event risk. AI? It’s hot but crowded. Valuations are stretched and growth narratives fragile. Smart investors track these sectors not just for gains, but as a read on how much risk the market’s willing to stomach.

Zoom out from the headline indexes. Real signals often live in the seams.

Global Ripple Effects to Watch

The U.S. market doesn’t move in a vacuum 2026 is proving that in sharp detail. Ongoing geopolitical tensions, trade wars, and alliance shifts are hitting supply chains and investor confidence faster than ever. When flashpoints emerge whether in Eastern Europe, the South China Sea, or domestic political uncertainty the market reacts in days, sometimes hours. Stability is getting harder to price in.

On the banking front, once mild tremors in global finance are now sending aftershocks far and wide. Central banks in Europe and Asia are retooling monetary policies, and their moves are echoing through U.S. equities. Tighter credit conditions abroad often mean volatility at home, and investors are learning (again) that liquidity is a global game.

Meanwhile, emerging markets aren’t just sideshow economies anymore. Areas like Southeast Asia and parts of Africa are setting both commercial and commodity trends. When capital flows there accelerate, or when their currencies swing, momentum in U.S. markets often follows especially in risk on or risk off pivots.

Commodities are also getting their overdue attention. Oil, copper, lithium they’re not just physical assets but directional signals. If you’re watching inflation, infrastructure booms, or energy insecurity and ignoring commodity movement, you’re missing half the picture. These cycles still speak loud, and 2026 isn’t likely to be an exception.

Seeing the Road Ahead Not the Rearview

The loudest investing mistake heading into 2026? Betting tomorrow looks like yesterday. Markets aren’t running a rerun. They’re reacting to new forces AI driven productivity, global policy fragmentation, climate linked spending shifts and they’re moving faster than ever. Looking back for a playbook is good training. But using it as a GPS will get you lost fast.

What works instead is a portfolio strategy that faces forward. That means stress testing assumptions under today’s data, not 10 year old patterns. It’s about building in agility, hedging for volatility, and knowing what signals are lagging and which are still real time. A forward looking portfolio isn’t just diversified; it’s dynamic.

Still, history isn’t useless. Map previous cycles not for mimicry, but for insight. How did warning signs look before the fallouts? What fueled recoveries faster than expected? If you’re charting your investment moves like a pilot in cloud cover, historical context is your radar. But your hands should stay on the wheel eyes on the horizon.

(For a refresher on the signals that shaped past cycles, check this essential read: historical bull and bear markets)